Thanks to high property taxes and rising inflation rates, the total cost of homeownership is higher than ever in Nassau County, making it difficult for many homeowners – especially the elderly and those with low to moderate incomes – to balance budgets.

Fortunately, there are exemptions provided by New York State and Nassau County that can significantly reduce your property tax bills. These programs can save you hundreds of dollars a year on your property taxes. This article will bring you up to speed on the current exemption programs available to you, discuss their eligibility requirements, and provide links to official program pages should you decide to participate in them.

Using The STAR (School Tax Relief) Program

If you’re not registered with STAR – the School Tax Relief program – you might be missing out. Perhaps you didn’t qualify the last time you reviewed your eligibility. If you did in the past register for STAR, rest easy: you only have to register once, and the NY Tax Department will send you a STAR credit check each year, or apply the exemption off your School taxes, for as long as you remain eligible. Keep in mind that if you transfer ownership of your home in any way, you will have to reregister.

STAR consists of two separate sub-programs: Basic STAR and Enhanced STAR. Basic STAR is open to the primary residence of any New York State resident, regardless of age. If your annual household income is $500,000 or less, you qualify for Basic STAR.

Enhanced STAR is designed for homeowners 65 years of age or older. For the 2023/24 tax year, if your 2021 household income is less than $92,300, you’re eligible. If you’ve never participated in this program, but currently have the Basic STAR exemption as a credit on your tax bill and want to enroll, you must complete and file the Enhanced STAR Application – along with any required documentation and forms – with the Nassau County Department of Assessment, on or before January 2, 2023. You can find the application form here: https://www.nassaucountyny.gov/DocumentCenter/View/37699/Enhanced-STAR-Application-2023-24?bidId=

Note that if you are currently enrolled in the Basic STAR credit program, once your age and income qualify, NYS will automatically bump you up to Enhanced STAR without having to apply or reregister.

Further, New York State recently changed the way that you will receive your STAR credit or exemption. Those making a yearly income of $250,000 or less will continue to receive exemptions on their property tax bill, provided they have been receiving the STAR exemption on their School tax bills. Those making between $250,000 and $500,000 will instead receive a check from New York State.

An important note for new homeowners is that all homeowners who purchased homes beginning in 2015 and going forward are required to register for the STAR credit program online at: https://www.tax.ny.gov/pit/property/star/ Applying the exemption to the School tax bill is not an option for these homeowners.

Bottom line, make sure you’re signed up for STAR if you believe you qualify. For more information about the STAR program, go to: https://www.tax.ny.gov/star/

Latest on Senior Citizen, Limited Income and Disability Exemptions

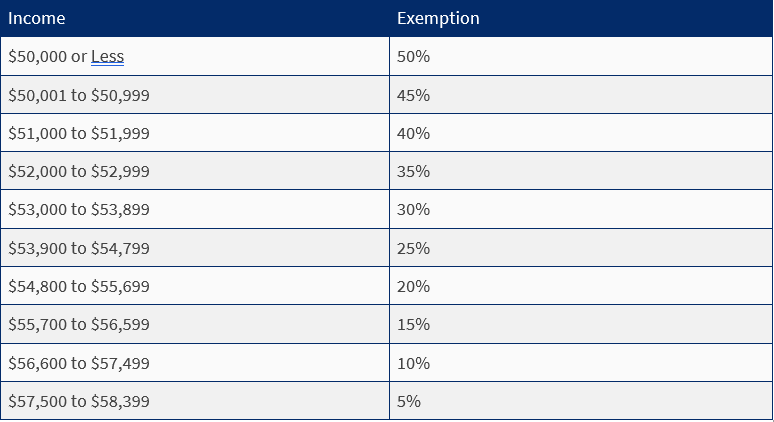

As we’ve previously reported, there have been recent updates to the income requirements for Senior Citizens and Disability exemptions. The 2021 household income threshold for homeowners 65 and over with limited income and a disability, including gross social security earnings, has now increased to $58,399 or less. Depending on your income, the exemption provides reductions between 5% and 50% on County, Town and School taxes, but no reduction in special district taxes. The 50% exemption applies to seniors whose income, including social security, is $50,000 or less. Below is chart of the qualifications for the percentage exemptions.

Another recent update states that homeowners who have received the Senior Citizens Limited Income Exemption for five consecutive years may file an affidavit in lieu of an annual renewal application with their property tax bill indicating their continued eligibility for the exemption.

For more information on the latest developments of these exemptions, visit https://hempsteadny.gov/395/Senior-Citizen.

Other Exemption Programs for Which You May Qualify

Additional programs are available for veterans, firefighters, and ambulance workers. Nassau County veterans who have received honorable discharges from service may be eligible for a real property tax exemption that may also cover surviving un-remarried spouses, dependent parents and dependent children. This exemption may result in a reduction of the County, Town, Village and Highway components of your property tax bills of up to 15 percent, with an additional 10 percent reduction for service in a combat area or for receiving an Expeditionary Medal. With respect to School Taxes, exemptions will only be honored in districts that have opted to offer this reduction. For more information on Veterans’ exemptions and links to applicable forms, go to: https://www.nassaucountyny.gov/3306/Veterans-Real-Property-Tax-Exemptions

Are you a Nassau County volunteer firefighter or ambulance worker? You may qualify for a Real Property Tax Exemption, provided you have volunteered for at least five years. The exemption equals 10 percent of the assessed value of your property for General tax purposes and may also apply to School taxes, provided that your local school district allows it. To apply for this exemption, you must complete and file Form NYS RPT 466c, with the Nassau County Department of Assessment by January 2, 2023. You can find the form here: https://www.tax.ny.gov/pdf/current_forms/orpts/rp466c_nassau_fill_in.pdf

Saving Beyond Exemptions

While it’s smart to take advantage of all the property tax exemptions to which you are entitled, it’s also important to utilize the services of an experienced tax reduction company like Maidenbaum to challenge your tax assessment. Maidenbaum’s team leverages its over 30 years of experience and analyzes each individual case with state-of-the-art technology to obtain the best results.

Remember, Maidenbaum will only charge you for the savings that it achieves and will not take credit for any property tax exemptions which you may have filed on your own. Maidenbaum’s work begins after your exemptions kick in. Get started with Maidenbaum today.